audit working papers are the property of

Click to see full answer. The auditor should avoid preparing or accumulating unnecessary working papers and should therefore avoid making extensive copies of the clients accounting records.

Bank Confirmation Sample Malaysian Institute Of Accountants

The Auditors Working Papers are divided into two parts is the specific guidelines and directions for efficient and effectivecompletion of the audit work on timely and daily basis so as to minimise audit risk.

. Herein who is the owner of audit working paper. Is this statement true or false. Working papers also provide evidence that an audit was properly planned and supervised.

Audit working papers are the property of the auditors who may. Thus the audit working papers are the property of auditor and not of the client. Those documents include summarizing the clients nature of the business business process flow audit program or procedure documents or information obtained from the client and audit testing documents.

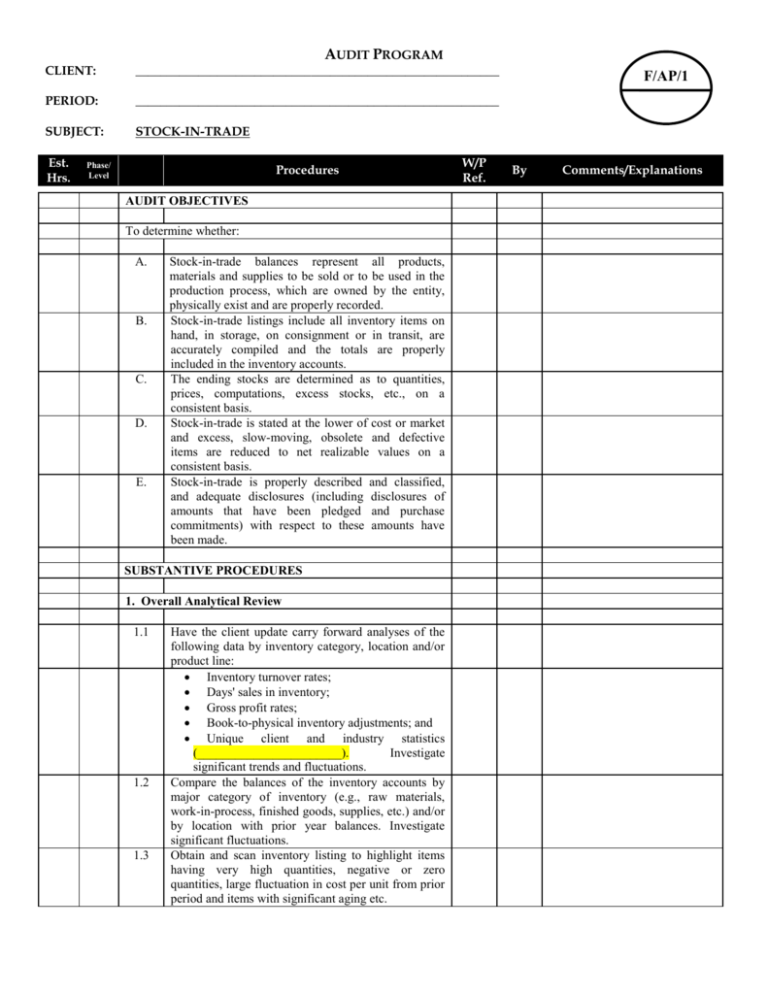

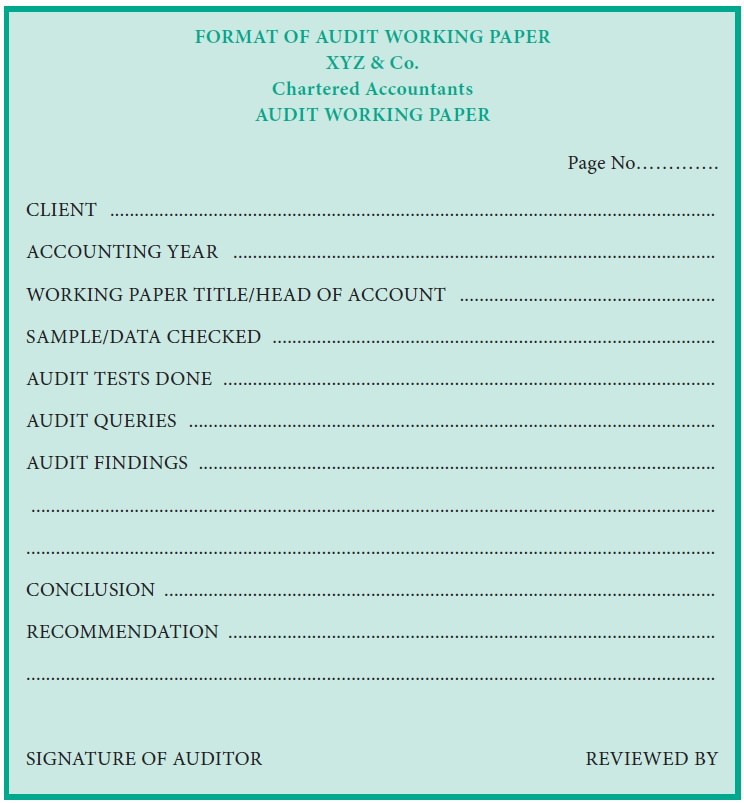

10 Audit Workpaper Templates in PDF WORD. Audit programme provides instructions to the audit staff and reduces scope for. Importance of Auditing Working Papers.

And the conclusions drawn from the evidence obtained. Audit working papers are sometimes referred to as audit documents that are a. Working papers are the record of various audit procedures performed audit evidence obtained allocation of work between audit team members etc.

Working papers are the property of the auditor and some states have statutes that designate the auditor as the owner of the working papers. Distort the papers sell them or give them to third part. Audit Working Papers can be defined as the documents that auditors record during the course of the audit whilst they are obtaining evidence regarding the companys financial statements and other relevant transactions.

AAS 3 states working papers should record the auditors plan the nature timing and extent of the audit procedures performed. They are not a part of nor substitute for the clients accounting records. Solved Answer of MCQ Audit working papers are the property of.

The Auditor may at his discretion make portions of or extracts from his working papers available to his clients. Although the client may claim them as a record of his business matters the auditor cannot part with them as his conclusions are based on them and as they provide evidence of the audit work carried out according to the basic principles. Thus the working papers are the property of the auditor.

The auditors rights of ownership however are subject to ethical limitations relating to the confidential relationship with clients. In order to keep professional ethic it cannot discover to third party without consent of the client unless limited specified situations mentioned in ISA 230 Documentation and required by law the. They cannot distort them because it can be used as an evidence if there would be.

Working papers are the property of the auditor and some states have statutes that designate the auditor as the owner of the working papers. Audit papers are the property of _____. In order to keep professional ethic it cannot reveal to third parties without client consent unless limited specified situations mentioned in ISA 230 Documentation and required by law the examples are court order.

Audit working papers are used to document the information gathered during an audit. The first statement is FALSE. The working papers are the property of the Auditor.

Justify with your explanation. The ownership of working papers belongs to the auditor. Audit working papers are the property of the auditor.

Audit working papers are the property of the auditor. Working Papers prepared or obtained by the auditor in connection with the performance of audit are the property of auditor and it is the duty of the auditor to retain and preserve the working papers for a period of 7 years. Audit Working Papers can be defined as the documents that auditors record during the course of the audit whilst they are obtaining evidence regarding the companys financial statements and other relevant transactions.

The working papers constitute complete and conclusive evidence in future as to the entirety and completeness of the audit work. So they are his property. This article is about audit working papers.

Audit working papers are the documents and evidence that an auditor collects and retains with himself during the audit. Working papers are the property of the auditor and some states have statutes that designate the auditor as the owner of the working papers. Contents of audit working papers.

Audit working papers are the property of the auditor. Auditors should prepare and organise their working papers in a manner that helps the auditor carry out an appropriate audit service. The working papers are the matters documented by the auditor.

Audit working papers are the property of the auditor. - a Client - b Accountant - c Auditor - d Registrar of companies - Advance Accounting and Auditing Multiple Choice Question-. Audit working papers refer to the documents prepared by or use by auditors as part of their works.

The auditors rights of ownership however are subject to ethical limitations relating to the. Audit working papers are the archives that record all review proof got during fiscal summaries examining inside administration inspecting data frameworks evaluating and examinations. Ownership of Audit working papers.

In order to keep professional ethic it cannot discover to third party without consent of the client unless limited specified situations mentioned in ISA 230 Documentation and required by law the examples are court order for public interest and so on. They provide evidence that sufficient information was obtained by an auditor to support his or her opinion regarding the underlying financial statements. Although audit working papers are property of the auditors they should not be sold distorted or given to third party as it will violate the Code of Ethics of Confidentiality because what is contain in the audit working papers are information about the client.

List several rules to be observed in the preparation of working. The auditors rights of ownership however are subject to ethical limitations relating to the confidential relationship with clients. Guidelines of Audit Working Papers as specified in SA-230 Audit Documentation.

A current audit file normally includes _____. View solution Where a Company suffers loss as a result of an auditors negligence and the directors do not take any action any member of the company may take action against the auditor by________________. An audit working paper is utilized to help the review work done so as to give the confirmation that the review was acted as per the.

Working papers are documents developed by auditors that summarize their work including evidence tests and conclusions related to the audit objectives.

Auditing And Accounting During And After The Covid 19 Crisis The Cpa Journal

Audit Working Papers Types Characteristics Information

Guide To Standard On Auditing Sa 230 Audit Documentation

Working Papers In The Audit Process Definition Development Study Com

Solutions Chapter 1 20 Lee Lee Academia Edu

Working Papers In The Audit Process Definition Development Study Com

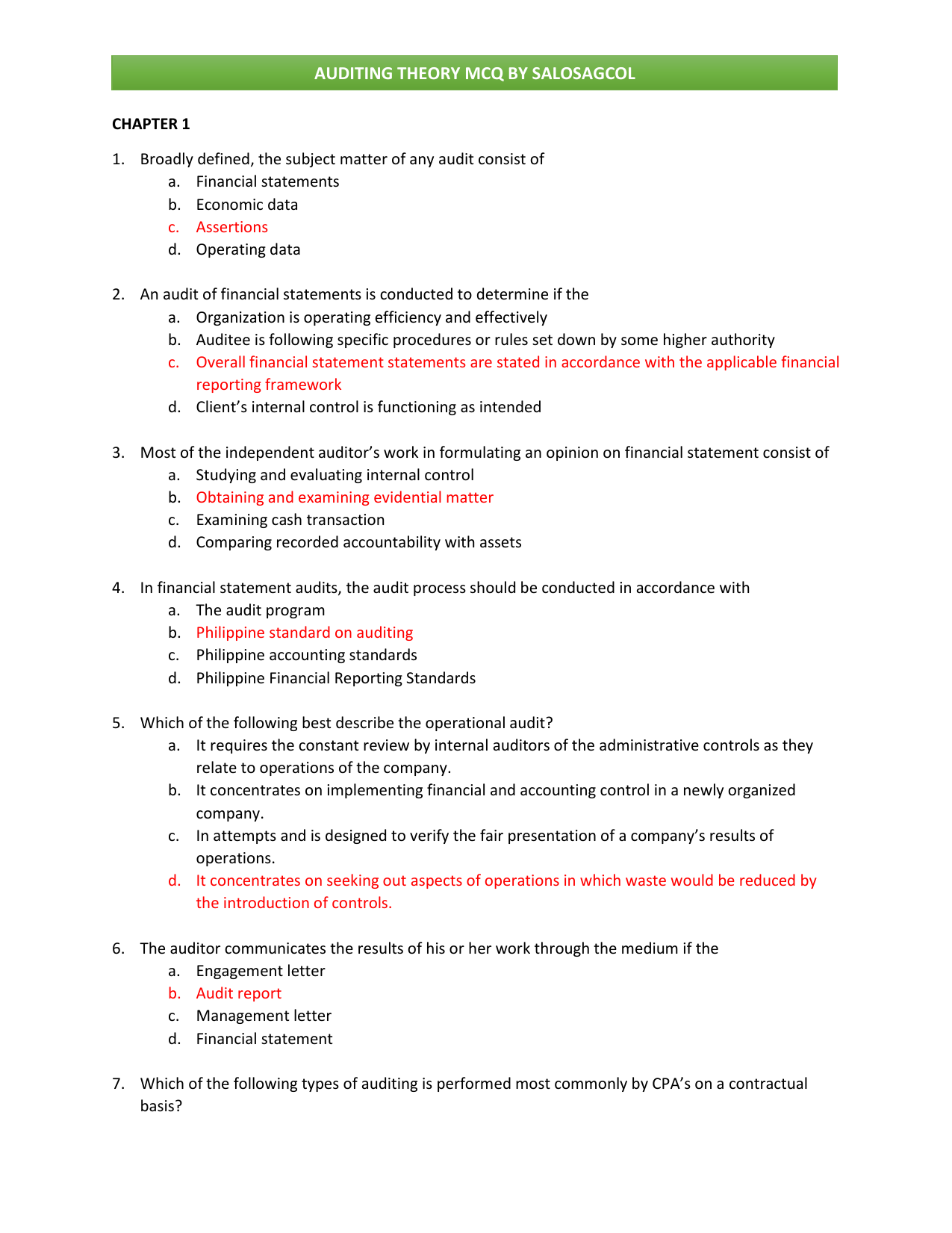

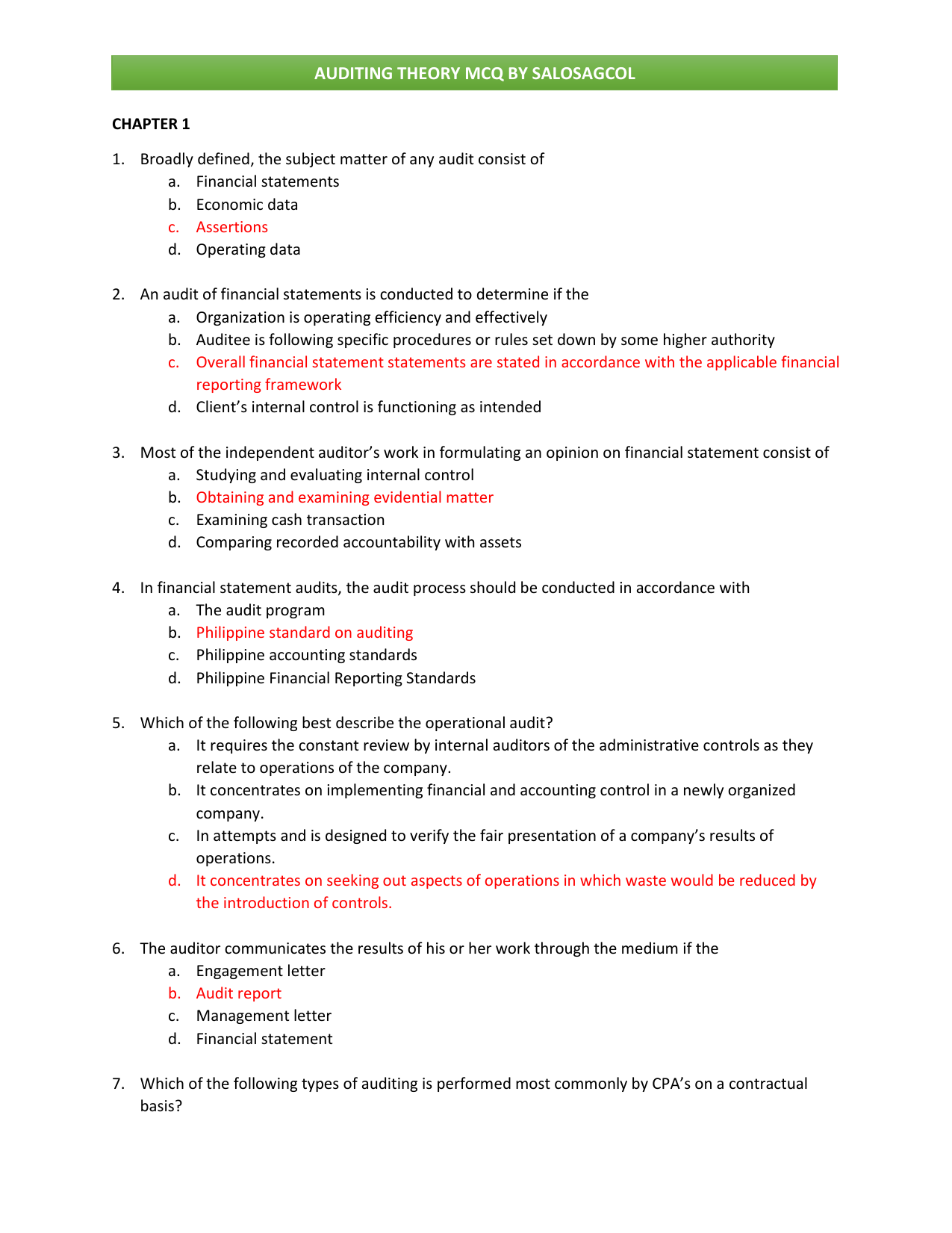

301451253 Auditing Theory Mcqs By Salosagcol With Answers

Guide To Standard On Auditing Sa 230 Audit Documentation

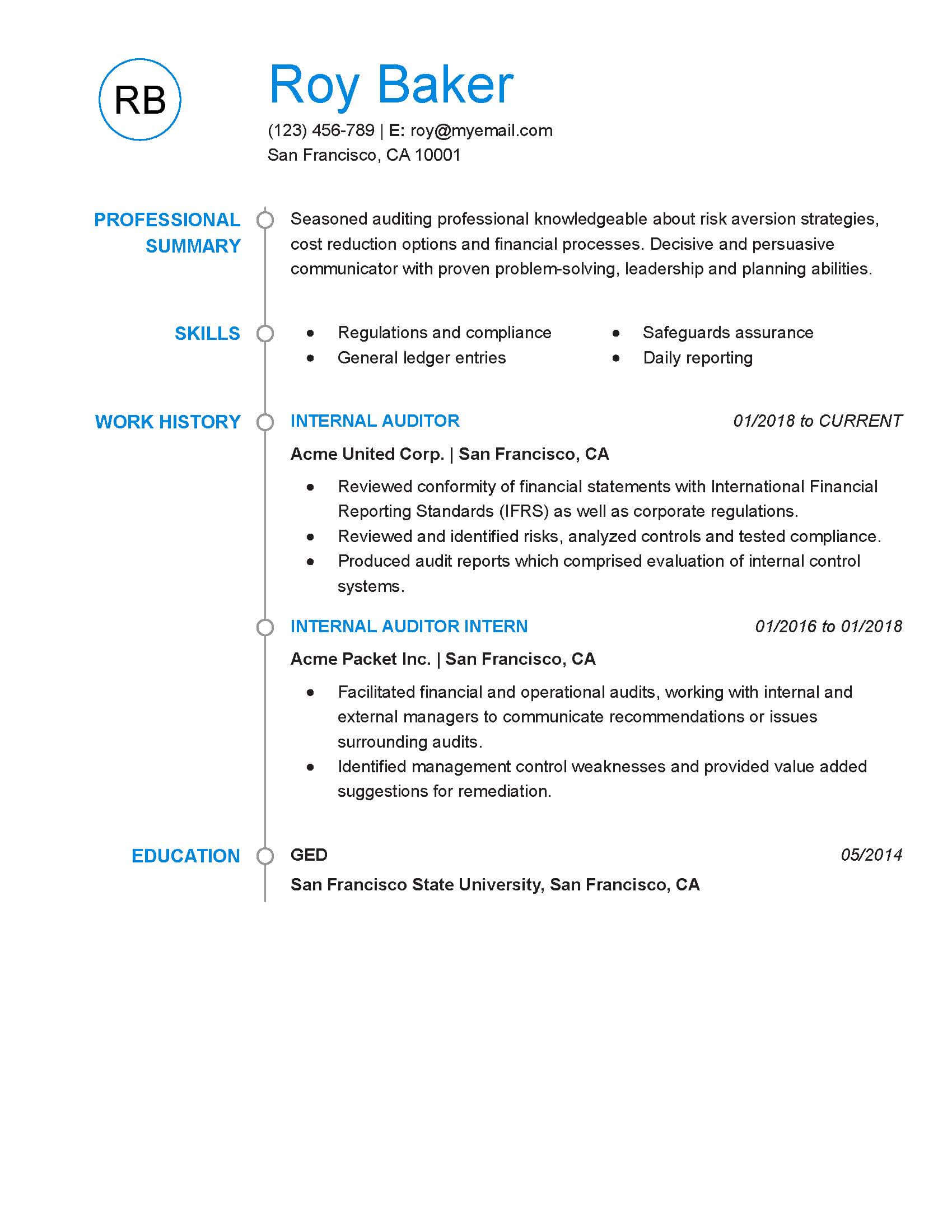

2022 Best Internal Auditor Resume Example Myperfectresume

Audit Findings Report Template 5 Templates Example Templates Example Report Template Templates Audit

Guide To Standard On Auditing Sa 230 Audit Documentation

Audit Working Papers Meaning Definition Contents Objectives Importance Or Advantages Auditing